The 6-Second Trick For Estate Planning Attorney

The 6-Second Trick For Estate Planning Attorney

Blog Article

The Ultimate Guide To Estate Planning Attorney

Table of ContentsThe 2-Minute Rule for Estate Planning AttorneyEstate Planning Attorney Can Be Fun For AnyoneThe Greatest Guide To Estate Planning AttorneyThe Definitive Guide to Estate Planning Attorney

Estate planning is an action plan you can use to identify what happens to your properties and responsibilities while you're active and after you pass away. A will, on the other hand, is a legal document that details exactly how assets are dispersed, who deals with children and animals, and any other wishes after you die.

Insurance claims that are rejected by the executor can be taken to court where a probate court will have the final say as to whether or not the insurance claim is legitimate.

Estate Planning Attorney for Beginners

After the supply of the estate has been taken, the value of possessions determined, and tax obligations and financial debt paid off, the executor will certainly after that look for authorization from the court to disperse whatever is left of the estate to the beneficiaries. Any kind of inheritance tax that are pending will come due within 9 months of the day of death.

Each private locations their assets in the trust fund and names a person apart from their spouse as the beneficiary. Nonetheless, A-B trusts have ended up being less preferred as the inheritance tax exemption functions well for many estates. Grandparents may transfer possessions to an entity, such as a 529 plan, to sustain grandchildrens' education and learning.

About Estate Planning Attorney

Estate coordinators can function with the benefactor in order to lower taxed income as a result of those payments or develop methods that maximize the impact of those donations. This is one more technique that can be used to limit death tax obligations. It includes a private securing the current worth, and therefore tax responsibility, of their building, while attributing the worth of future development of that funding to another individual. This method includes cold the worth of a property at its worth on the day of transfer. As necessary, the quantity of possible capital gain at death is additionally frozen, permitting the estate coordinator to estimate their possible tax obligation responsibility upon fatality and better prepare for the repayment of revenue tax obligations.

If sufficient insurance coverage profits are readily available and the plans are effectively structured, any earnings tax obligation on the considered personalities of properties adhering to the fatality of an individual can be paid without turning to the sale of possessions. Earnings from life insurance policy that are obtained by the beneficiaries upon the fatality of the guaranteed are generally revenue tax-free.

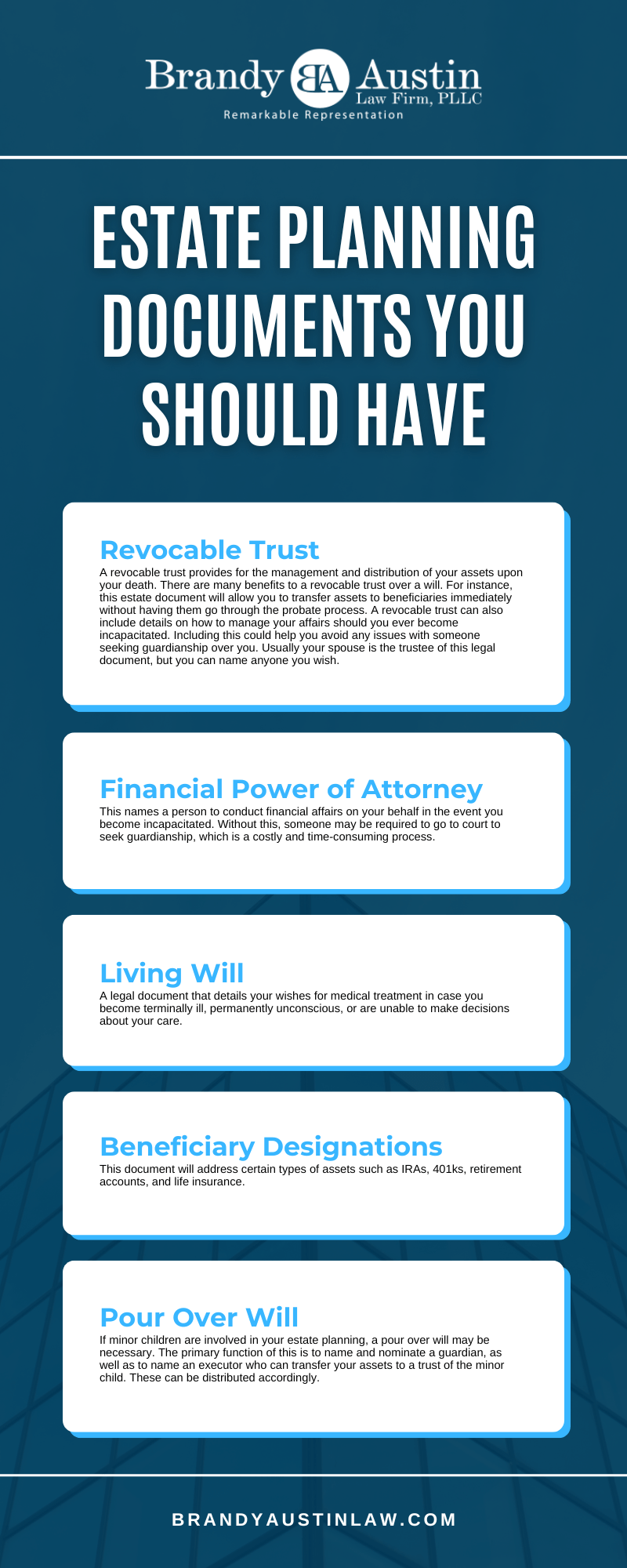

There are certain click for more files you'll require as part of the estate planning procedure. Some of the most usual ones include wills, powers of lawyer (POAs), guardianship classifications, and living wills.

There is a myth that estate preparation is just for high-net-worth individuals. That's not real. As a matter of useful content fact, estate preparation is a device that everyone can use. Estate planning makes it easier for people to establish their dreams prior to and after they die. In contrast to what the majority of people believe, it expands past what to do with possessions and obligations.

Unknown Facts About Estate Planning Attorney

You need to start intending for your estate as soon as you have any measurable possession base. It's a recurring process: as life advances, your estate strategy ought to change to match your circumstances, according to your brand-new goals. And maintain at it. Not doing your estate planning can trigger excessive financial concerns to enjoyed ones.

Estate preparation is frequently taken a device for the well-off. However that isn't the instance. It can be a helpful way for you to take care of browse around this web-site your properties and responsibilities before and after you die. Estate planning is also an excellent method for you to outline strategies for the treatment of your small youngsters and pets and to outline your long for your funeral service and favorite charities.

Applications need to be. Qualified applicants who pass the examination will certainly be formally certified in August. If you're eligible to sit for the exam from a previous application, you may submit the brief application. According to the rules, no accreditation shall last for a duration much longer than 5 years. Learn when your recertification application is due.

Report this page